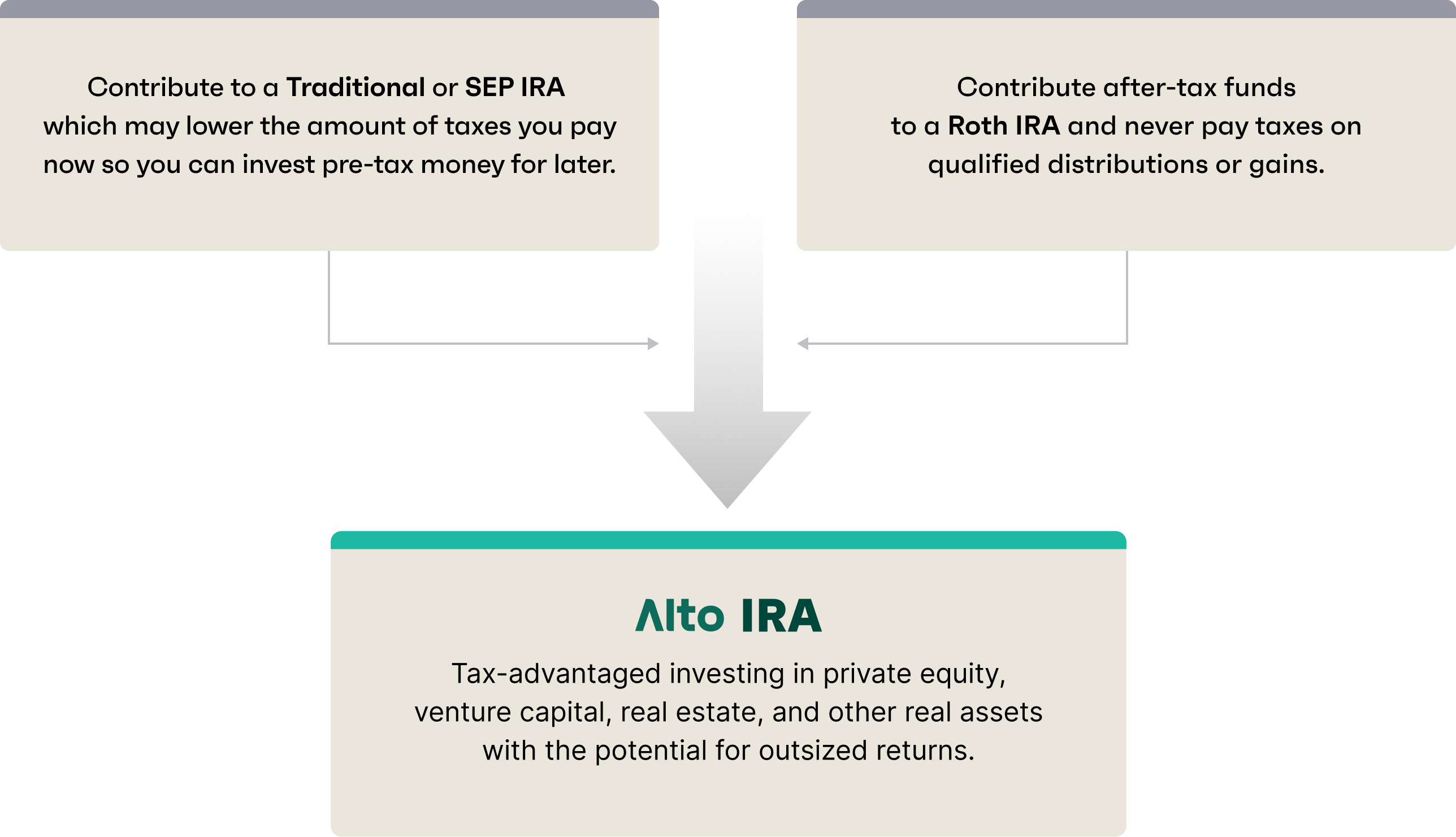

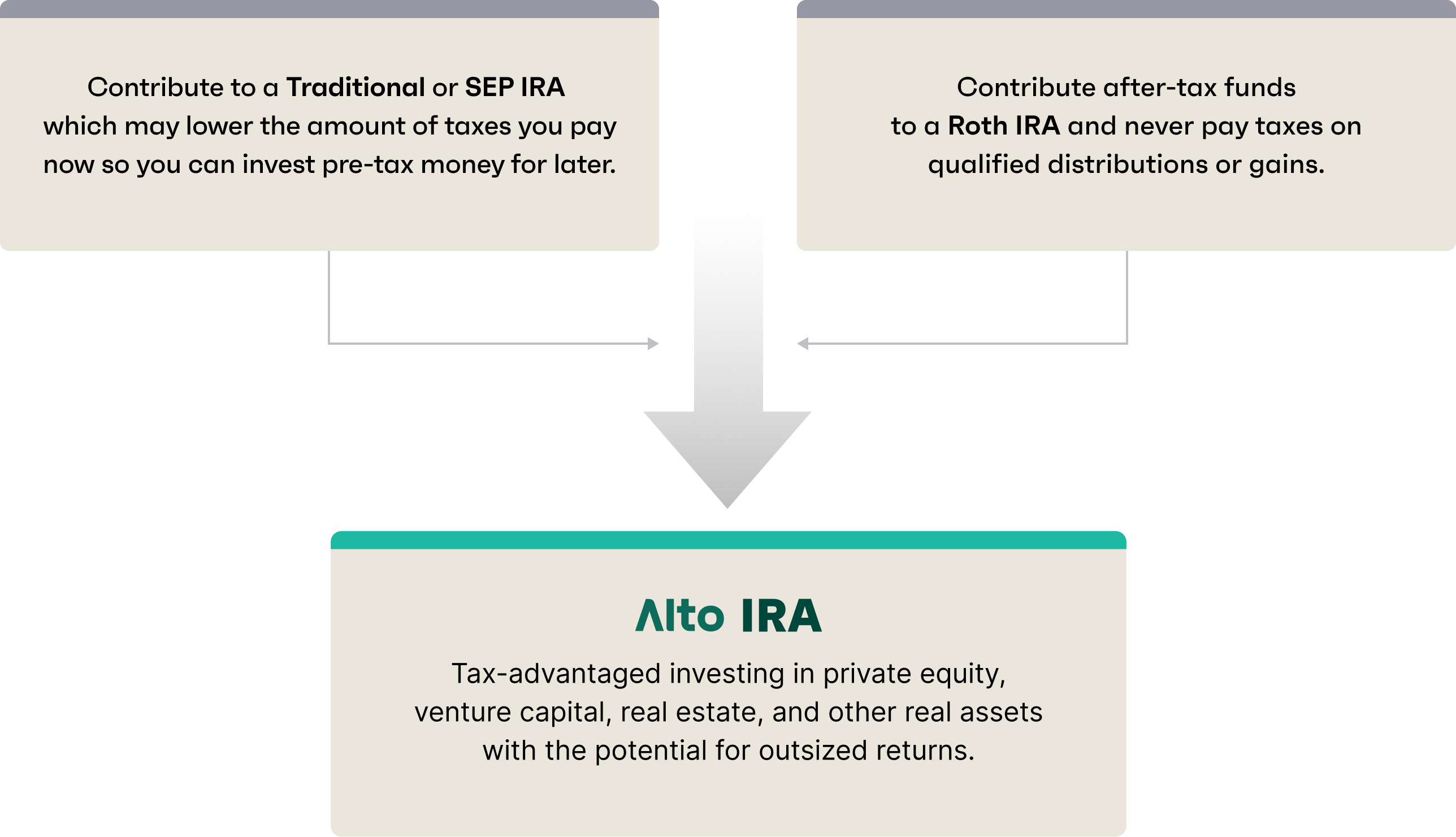

Defer and even eliminate taxes on your investments*

Alto provides investors with a self-directed IRA that serves as a powerful way to shield investment returns from capital gains taxes.

Build wealth and diversify your portfolio with private market investments.

Over

$2B

in assets under custody

Over

32,000

investors

Longer time horizon

Investing in alternatives with a self-directed IRA aligns long-term investment horizons with saving for retirement, an overlap in financial strategy we refer to as duration matching.

Historically resilient

Alternative assets offer potential insulation from public market risk, which may help investors saving for retirement grow their portfolio on a risk-adjusted basis.

Tax benefits

Retirement funds are tax-advantaged, appealing to investors who look for ways to keep as much of their investment earnings as possible.

Explore Alto options

Alto Marketplace is the leading self-directed IRA platform connecting sophisticated investors looking to diversify their portfolios with exclusive, highly sought-after issuers of alternative assets diversifying their fundraising methods.

A private equity fund specializing in late-stage U.S. firms in defense, energy, cybersecurity, and AI.

An income-focused investment in Carolina workforce housing, offering low-volatility exposure.

Short-term, high-yield notes backed by Ginkgo with rolling maturities for liquidity.

Alto connects self-directed IRAs to some of the most esteemed alternatives platforms available today. After selecting an investment, investors can simply pay for an offering with their self-directed IRA and let Alto do the rest.

Raising capital for alternative assets has long been known as a cumbersome, paper-intensive process. Alto modernizes the process with a simple, single-login digital interface that makes raising self-directed IRA capital more efficient.

Alto provides investors with a self-directed IRA that serves as a powerful way to shield investment returns from capital gains taxes.